Navigation Tool

Tutorial

Break-Even Analysis Service Company

An important step in preparing the business plan is the break-even analysis.

Managers, on a regular basis study the effect of internal decisions and outside conditions that affect revenue and expenses. Revenue is affected by competitors, pricing policies and changes in the market demand for products and services. Expenses are affected by prices paid for products, the volume of sales and other factors.

An important aspect of planning to meet profit goals is to analyze the effect of increased sales on net income. This is often referred to as "break-even analysis".

The break-even point is the point at which a business moves from a loss to a profit position. Many business owners make the mistake if bringing a product or service to the market without understanding all the costs involved and the prices they charge.

As a consequence, the entrepreneur may discover that they can not sell enough of the product or service to make a profit. A break-even analysis enables you to determine if your idea is profitable. The break-even analysis will show you how much of your product or service must be sold to generate a specific level of profitability.

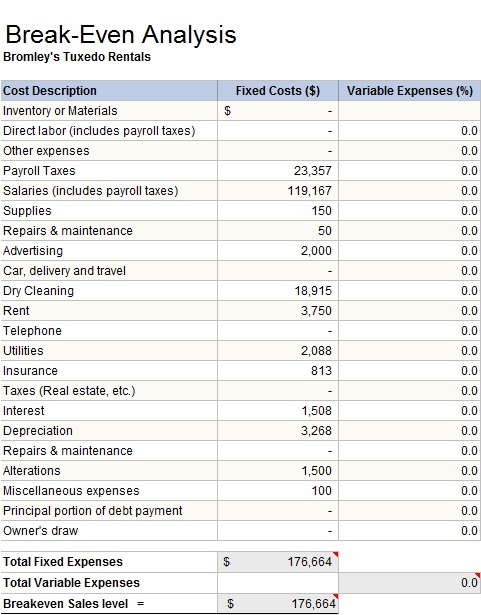

Click to enlarge

The image above is a picture of a break even analysis. The numbers for Bromley's Tuxedo Rentals were entered and the Excel spread sheet's formulas calculated the break even dollar sales at $176,664.46. If we divide the sales number needed to break even, we would need to rent 1,413 each month at $125.00

Prepare a Break Even Analysis for your company. Load in the Break Even Analysis Template from the projects box above and enter your company's numbers. Save and print out a copy. A break-even analysis is required in the business plan.

The break even analysis is can done in a graphical representation with the horizontal axis representing number of tuxedos rented. The vertical axis represents dollars of revenue or expenses. First the revenue line is plotted, running from zero volume of sales to $176,664.46 representing the rental of 1,413 tuxedos at $125 a piece per month. Remember, however, the sales contract with the VEC means that they will be buying 953 tuxedos from you. You will need to rent and additional 450 tuxedos each month

Importance of sales at open houses, trade fairs

The sales contract from Virtual Enterprise will be 119,166.67. We will need to come up with $57,497.79 each month from grand openings, open houses, trade fairs and on-line sales just to cover our expenses. Each company must come up with the extra effort to sell additional services or merchandise each month for your company to be successful, for all your employees have enough work to do, so that each employee can still be paid and buy merchandise to keep the virtual economy moving forward.

It is the responsibility of the accounting department to make sure that top management, follows through on its extra efforts to make up the difference between the VE contract and costs associated with running the business.

Some type of activity must happen each month to achieve a profit.

Bromley's Tuxedo Rentals Sales Projections

| Trade Show/Open House/Internet Projections

|

| Month | Event | Amount |

| November | Open House | $60,000 |

| December | Trade Show | $70,000 |

| January | Open House | $60,000 |

| February | Trade Show | $65,000 |

| March | Trade Show | $75,000 |

| April | Trade Show | $65,000 |

We are projecting the following in sales for our first year.

Note: Trade Show Dates vary. Plan one activity a month to make up the difference between the Business Contract and total expenses.

Let's look at the first November's Income statement for the tuxedo rental business. We need to calculate the income for November. We know that $119,166.67 will be coming from Virtual Enterprise. We need to classify this amount as sales. If we have no additional sales, we will lose $57,497.79 If you look in the second income statement just to the right of the tutorial box, you will see that $57,497.79 amount has been added and our net profit is zero. We plan is to rent tuxedos for $125.00 each. If we divide our total sales of 179,166.67 by 125 we get 1,413 rentals each month for our projected sales volume.

The third service business income statement shows a $60,000 open house. Now all that is left is to calculate the net income for November. All you need to do for a service business to calculate the net income is to subtract the total expenses from the total revenue or sales. As you can see the projected net income for the tuxedo rental business is now $2,502.21.

To see the projected income for the first year. Click on the link for "Service Projection Key" in the projects box above.

After viewing the tuxedo rentals yearly projections, download the template for service projections and enter your company's data.

Check your amortization table for the amounts of monthly interest. Bromley's Tuxedo Rentals amounts are in the projections.

Please fill out the income statement projection form for your own company. use the Template link for your type of business in the projects box.

Break-Even Analysis Merchandising Company

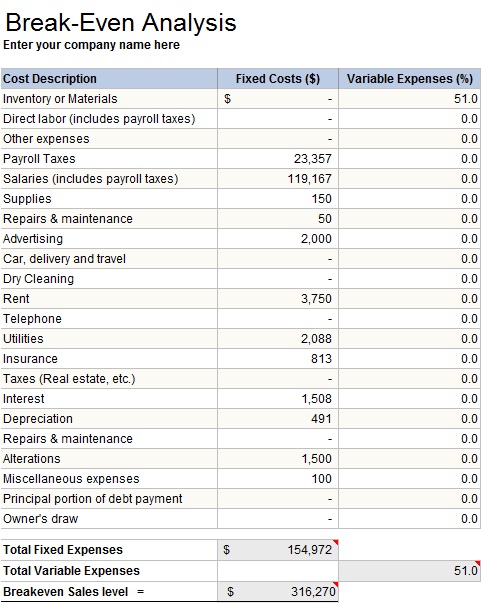

Click to enlarge

Calculating the break-even point for a merchandising business is a little more complicated than for a service business. We are still dealing with fixed and variable costs. The fixed costs remain the same. Those costs are the ones that continue whether we sell anything or not. Examples include rent, utilities, insurance, etc. The variable costs involve the merchandise that we buy to resell to our customers. In the case of the formal wear business, these are mens' suits, dress shirts, ties, bridesmaids' dresses, bridal gowns, etc.

- The formal wear business has a sales contract of $180,025.08.

- The fixed costs = $154,972.

- The variable costs - cost of goods sold is entered as a percentage (.5107).

- This percentage was obtained from BizStats.com.

- The spread sheet's formulas calculate the break even amount based on the numbers entered.

- As you can see, the break even sales number is $316,270.

- The business contract is for 180,025.08.

- If we subtract business contract sales from the break even number, we can see we need to generate an an additional $136,244.92 worth of sales each month to just cover our expenses.

- If an average sales is $500, we would need 272 extra sales per month(136,000/500)

A projected November income statement for Bromley's Formal Wear appears in the far right column, the second one down. The additional sales of $136,244.92 have been added into the total revenue total.

Here is the formula for determining break even point

- Break Even Level = Total Fixed Expenses/((100-Total Variable Expense Percentage)/100)

- If we substitute our numbers into the formula, the results look like:

- BE = 154,972/100-51)/100

- BE = 154,972/.49)/100

- BE = 31,626,938/100

- BE = 316,270

Click on the link in the projects box for the Bromley's formal wear projections to see how Bromley's plans to at least break even and turn a profit.

Things that need to be done to have a positive income statement for November - April

- November - 136,270 open house cash sales

- December - 70,000 in trade fair sales and 100,000 in Internet/other sales

- January - 60,000 Open house and 100,000 in Internet/Other sales

- February - 65,000 trade show sales and 100,000 Inter.other sales

- March - 75,00 trade show sales and 100,000 Internet/other sales

- April 65,000 trade show sales and 100,000 Internet/other sales

Using these projections a profit can be made each month.

Do a break even analysis for for your own company using the merchandising BE template in the projects box or using the formula above. This report should be included in your business plan.

Also make a sales November through April sales projection for your company using the template in the projects for the week box.

Cash Flow Analysis

Service Business

Management is always concerned with having enough cash to meet its operating needs and to pay on any outstanding loans. Cash is the most liquid asset, and the efficient use of cash is one of the accounting department's most important tasks. Liquidity refers to the ability to pay debts as they come due. A cash flow statement is often prepared in order to give a full and complete picture of cash receipts and cash disbursements for an accounting period.

Our start up cash is as follows.

Account Name | Amount | Cell |

Seed Money | $85,000 | B5 |

Business Loan | $150,800 | B11 |

Total Cash Available | | $275,800 |

Furniture and Fixtures | $47,000 | |

Office Equipment | $2,300 | |

Office supplies | $1,500 | |

Other Assets/Rental mdse | $100,000 | |

Capital Purchases | $150,800 | B35 |

Cash balance November | | $125,000 |

Our next step is to look at our projected income statement for November. Our beginning cash balance is $85,000. We know that we are short $57,497.79. A $60,000 open house will erase the deficit and leave a small profit. Remember to look at our income statement for Bromley's Tuxedo Rentals. The amount of projected sales for November is $119,166.67 + 60,000 = $179,166.67. Remember that our VE contract for Salary expense is $119,166.67 of this. The additional $60,000 is our projected cash sales for our open house. Our total cash received is now $264,166.67 (179,166.67 + 85,000)

We need to start paying on our loan of $150,800 Remember the terms of the loan were 10 years at 12% interest.The amount of the payment is $2,163.54 each month. For the month of November, $655.54.

per month goes toward the principal and $1,508.00 goes toward the interest. Check out the income statement to see the interest expense.

A cash flow analysis will show the payment of our loan and all of our expenses. We can get the expense amounts from the income statement shown on this page

| EXPENSES | |

Account Name | Amount | Cell |

Salary Expense | 119,166.67 | C18 |

Rent Expense | 3,750.00 | C19 |

Repairs Expense | 50.00 | C20 |

Alterations Expense | 1,500.00 | C21 |

Dry Cleaning Expense | 18,915 | C22 |

Advertising Expense | 2,000.00 | C23 |

Supplies Expense | 150.00 | C24 |

Depreciation Expense | | |

Insurance Expense | 812.50 | C25 |

Miscellaneous Expense | 100.00 | C26 |

Payroll Taxes Expense | 23,356.67 | C27 |

Legal And Accounting | | |

Utilities Expense | 2,087.50 | C29 |

Bad Debts Expense | | |

Interest Expense | 1,508.00 | C31 |

Delivery Expense | | |

Total Expenses | | 173,396.34 |

Loan Payment-Principal | 655.54 | C34 |

Total Expenditures | | $174,051.88 |

Loan payment on the principal is $655.54 for the month of November. Remember that the interest due on the loan is different each month. For November, the interest on the loan is $1,508.00. See table below for amounts for November through April.

Bromley's Tuxedos Rentals Loan

Month | Principal | Interest |

November | 655.54 | 1,508.00 |

December | 662.10 | 1,501.44 |

January | 668.72 | 1,494.82 |

February | 675.41 | 1,488.14 |

March | 682.16 | 1,481.38 |

April | 688.98 | 1,474.56 |

Depreciation expense is not an out of pocket expenditure and therefore, is not calculated in a cash flow analysis.

- Add up all expenditures to get the total for November.

- To find the cash balance subtract the total expenditures from the total cash available ($304,664.46 - $174,051.88 = $130,114.79).

- The cash balance at the end of November is $130,114.79.

- This amount, $130,114.79 becomes the cash on hand for December 1.

- Looking at December there a couple of changes.

- All of the expenses remain the same.

- Our Cash receipts do not include the sales amount from the trade show.

- The money generated from these projected sales of $70,000 is not received at the time of the sale.

- When you get back from a trade show, you need to issue invoices or bills to the people who bought goods or services from you.

- This money will not come in until you send them a bill.

- This amount is referred to as accounts receivable and will hopefully come in next month. In other words, you make the charge sale to people at the trade fair.

- Your books show the sale, but not the money received. That comes in next month after you have billed the customers and you see the money deposited into your bank account.

The ending cash balance from one month is the beginning cash balance for the next month. All sales are not cash sales.

For Example, the amount if ending cash balance for November (cell C39) should be copied into cell D5, which is the beginning cash balance for December.

The 70,000 projected charge sales amount for the trade show in December should go in cell E9. All expenses are the same.

For the loan numbers, see the table above for principal and interest per month.

If you click on the link for cash flow analysis, you can see a completed cash flow analysis for the months of November through April for Bromley's Tuxedo rentals. It is absolutely imperative that you collect the money owed to you from sales at trade fairs. Failure to do so would negatively impact your cash flow. If you do not have sufficient cash to meet your expenses and loan obligations, you will go broke.

Create a cash flow analysis for your company. Use the template in the projects box.

Bromley's Formal Wear Cash Flow Projections

The procedure is basically the same for producing a cash flow statement for a merchandising business.

- Don't forget the business contract amount of 180,025.42.

- The contract for a merchandising business consists of two parts: salary expense and COGS amount.

- Look at the income statement for Bromley's Formal Wear to obtain the expenses.

- Purchases is a large expenditure each month. It is automatically calculated for you.

- Your cost of goods sold percentage should be entered into cell B2. To obtain amount of merchandise needed, this percentage is multiplied times total revenue.

- When you do your own company's cash flow analysis, don't forget to put in the amounts of projected sales from trade shows and open houses,internet sales, etc.

- Interest on the loan changes each month. Look at your table above for exact amounts for December-April.

- Currently most of our sales at trade fairs come from charge sales.

- We anticipate some cash sales from visitors, judges and others with virtu-cash.

To help you with your own company's cash flow, you can click on "Cash Flow Analysis Template." Put in your company's numbers. Remember to include any additional expenses. Have your loan amortization schedule available for your loan to obtain interest and principal payments.

After examining the cash flow analysis for Bromley's Formal Wear, there are a few cash flow problems. We do not have enough cash for February, March, April. We need to create more cash sales for these months. We need open houses, Internet sales or any other form of cash not charge sales.

The revised cash flow analysis for the formal wear company includes extra cash sales for the months of Feb-$10,000, March-$15,000 and April-$10,000. Without these additional cash sales projections, they would run out of cash and not have enough to pay their bills. Another way to increase cash flow is to generate more charge sales at the trades shows. You can play with these numbers if you wish to get a new cash flow for Bromley's Formal Wear.

If cash sales are not increased for Bromley's Formal Wear, then amount of charge sales from trades shows must be increased to 100,000, 90,000, 125,000 in order to meet the cash requirements needed.

Importance of these reports

Break-even analysis, sales projections and cash flow analysis are critical to the decision making process in all companies. These numbers dictate to other departments how to proceed with the marketing efforts, and other organizational priorities. It is at this point, that changes in the business model need to be implemented if not enough net profit is generated and not enough cash on hand is available to cover existing expenses. Here is where the CFO needs to meet with the CEO and Marketing VP to decide if changes need to be made in the product line, pricing and advertising strategies, the importance of Internet sales, attendance at trade shows, planned open houses and grand openings.

Prepare a cash flow for your company. Use the template available to in the projects for the week box.